Acquiring

How do interchange fees work?

What are interchange fees? Interchange fees are the fees exchanged between acquirers, issuers and the card schemes to which they belong. Interchange fees are usually related to the value or number of card payment transactions and are set by the card schemes for their acquirer and issuer members. The direction of interchange fee flow also varies…

Read MoreHow does a card payment work?

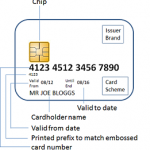

Most of us are comfortable these days with using a credit or debit card to make a payment, whether in store or increasingly, online. But how many of us really know how the card payment works and what’s happening behind the scenes? And how many payments professionals might shamefully concede that the underlying flows are…

Read More7 ways to improve your merchant acquiring bottom line

Is competition, churn and increasing cost hurting the bottom line of your merchant acquiring business? Are you struggling to differentiate your offering from a swathe of “me too” competitors, or worse, looking pale by comparison with emerging fintech startups? If so, you are not alone. Merchant acquirers everywhere are feeling the heat and searching for…

Read MoreIs Dynamic Currency Conversion dead?

Many acquirers, merchants and even some cardholders will be well aware of Dynamic Currency Conversion or DCC as it’s commonly referred to. DCC involves a cardholder being offered the choice to choose their own currency during an international Visa or MasterCard transaction at the point of sale, as opposed to the normal process which does…

Read More