How does a card payment work?

Most of us are comfortable these days with using a credit or debit card to make a payment, whether in store or increasingly, online. But how many of us really know how the card payment works and what's happening behind the scenes? And how many payments professionals might shamefully concede that the underlying flows are a bit of a mystery?

Most of us are comfortable these days with using a credit or debit card to make a payment, whether in store or increasingly, online. But how many of us really know how the card payment works and what's happening behind the scenes? And how many payments professionals might shamefully concede that the underlying flows are a bit of a mystery?

This post will unravel the mystery and reveal the hidden money flows between the various participants in a card payment transaction.

The Participants

This post will focus on "four party" card payment schemes, in which the acquirer and issuer are separate members of the card scheme. Examples of four party card payment schemes include those involving Visa, MasterCard and UnionPay. (Three party card schemes are where the acquirer and issuer are the same. Examples include American Express and Diners Club).

The principal participants in a four party card scheme are:

- The merchant.

- The acquirer.

- The issuer.

- The cardholder.

(The card scheme itself is also a key participant as it is the "glue" that binds the four participants together).

Merchants

A merchant accepts payment from the cardholder and has a commercial arrangement with the acquirer for the processing of the card payment transaction and for funds settlement. In some cases, merchants contract with a Payment Facilitator that has a commercial arrangement with the acquirer, rather than directly with the acquirer. But ultimately, a merchant is responsible for accepting payments from cardholders and delivering them to the acquirer for processing.

Acquirers

Acquirers are usually financial institutions that are members of the participating card scheme. They provide the card acceptance facilities to their merchants, and then submit the merchants' transactions to the card scheme for authorisation, clearing and funds settlement. Acquirers usually derive their income from charging merchant services fees to the merchant for processing the transactions. Acquirers also pay the card schemes interchange and other processing fees in exchange for the card scheme acting as the "broker" with the card issuers.

Issuers

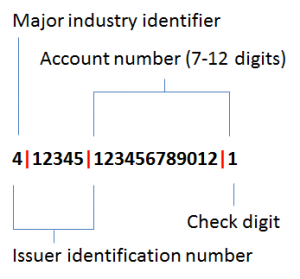

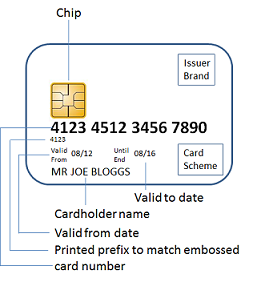

Issuers are also typically financial institutions that are members of the participating card scheme. They issue cards to cardholders which are attached to debit or credit account facilities. The cards are issued with Primary Account Numbers (PANs) that represent the underlying account, and identify both the issuer and account (card) holder throughout the payment process.

PANs follow a numbering system defined by the International Standards Organisation (ISO/IEC 7812). All card schemes conform to the standard so that participants and their systems can recognise one card scheme branded card from another.

Cardholders

Cardholders hold debit or credit accounts with their issuers and are ultimately responsible for funding those accounts. Issuers will draw funds from cardholders' accounts to settle funds with the card scheme. The card scheme will settle with the acquirer, and the acquirer will ultimately pay settlement funds to the merchant where the cardholder performed the original payment.

Card scheme payment flows

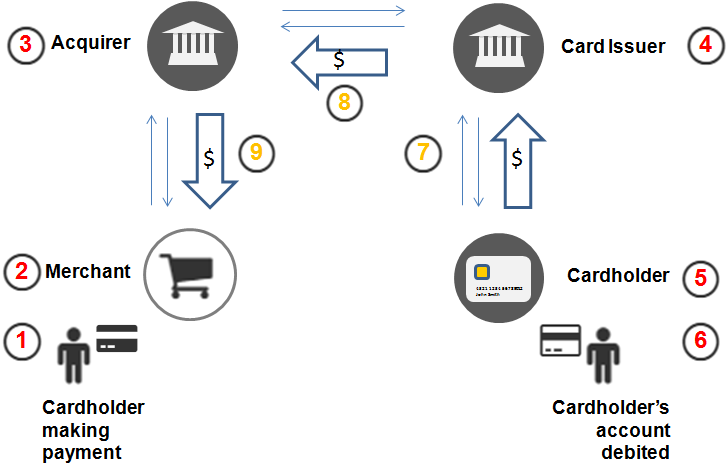

The four participants interact with each other during a card transaction, as follows:

The transaction works like this:

- The cardholder presents their card at the payment acceptance device once the merchant has initiated the transaction. Payment devices typically support magnetic stripe cards that are swiped at the payment device's magnetic stripe reader (MSR), EMV "chip" cards that need to be inserted into the payment device's card insertion slot, or EMV "contactless" cards that communicate with the payment device using Near Field Communications (NFC).

- The payment device will read the PAN from the card (and potentially other information) and may also prompt the cardholder to select an account, enter their PIN or confirm their currency (in the case of a Dynamic Currency Conversion transaction). The payment device will also construct and transmit a transaction message to be submitted to the acquirer's host system over a suitable communications pathway (dial-up line, Internet, wireless GPRS/3G/4G etc).

- The acquirer host will interrogate the PAN and determine which card scheme the transaction should be routed to. Once it has determined this, it will forward the transaction to the card scheme via its connection to the card scheme, or possibly via a network acting as an intermediary. The card scheme will forward the transaction to the card issuer which it has identified from the PAN.

- The card issuer receives the transaction and identifies the relevant cardholder account from the PAN.

- The issuer will typically check that the PAN identifies a valid account and that there is a suitable account balance in the case of a purchase transaction. It may also apply other business rules to minimise the possibility of fraud.

- The issuer will then apply the transaction against the cardholder's account. If the cardholder has performed a purchase at the point of sale, then the issuer will check that there is enough funds available to "approve" the transaction.

- Assuming that the transaction is approved by the card issuer and completed by the merchant, the issuer will ultimately draw settlement funds from the cardholder to pay for the purchase transaction.

- The issuer will settle those funds with the card scheme, and the card scheme will settle funds with the acquirer.

- The acquirer will then settle funds to the merchant to close out the transaction cycle.

When the issuer approves the online transaction request in step (6), it then returns a transaction response which includes the approval response (eg. approved or declined), an authorisation ID and other information. This transaction response is returned all the way back to the payment device through the card scheme and acquirer. The payment device will also typically print a transaction receipt which includes the approval result and acts as a record of the transaction for the merchant and cardholder.

Although not shown in the diagram, the acquirer will typically perform a clearing and settlement process with the card scheme later in the day. This usually involves the acquirer sending a file of all transactions to be settled by the card scheme with the issuer. The card scheme will also perform a similar process with the card issuer. The successful exchange of clearing files is followed by the card scheme exchange settlement funds ...with the acquirer on the merchant's side of the transaction and the issuer on the cardholder's side.

Steps (7)-(9) show funds being paid by the cardholder to the merchant via the issuer, card scheme and acquirer. This is how the merchant is ultimately reimbursed for the goods or services provided to the cardholder at the place and point of sale.

Four party card scheme model - pros and cons

The card scheme acts as an honest broker between acquirer and issuer, and as a trusted settlement intermediary. It sets operating rules for the participants and enforces compliance. It encourages merchants to accept its card brand and issuers to provide cards to their cardholders. By encouraging both acceptance and issuance, it delivers "network benefits" to everyone involved.

On the other hand, this model also involves a layer of cost that must be paid for. Card schemes charge acquirers and issuers for the benefits of membership and participation, but ultimately these costs are passed onto the merchants and cardholders. Merchants pay merchant services fees, and cardholders pay account and transaction fees, and in the case of credit cards, interest.

The future?

The four party card scheme model isn't going anywhere soon. Visa, MasterCard and UnionPay are growing year-on-year as transaction volumes increase. But other players such as Apple and Google (see Should-visa-and-mastercard-be-scared-of-apple-and-google/) and competing technologies (blockchain distributed ledgers) could challenge the traditional card schemes in years to come.

But until then, rest assured that a complex and sophisticated process is occurring behind the scenes to ensure that your card payment completes reliably, securely and swiftly as possible!